Debt can be a significant burden, affecting your financial well-being and overall quality of life. However, with the right strategies and determination, you can manage and reduce your debt effectively, paving the way to financial freedom. In this guide, we'll explore proven techniques to help you take control of your debt, prioritize repayments, and achieve a debt-free future.

1. Assess Your Debt Situation

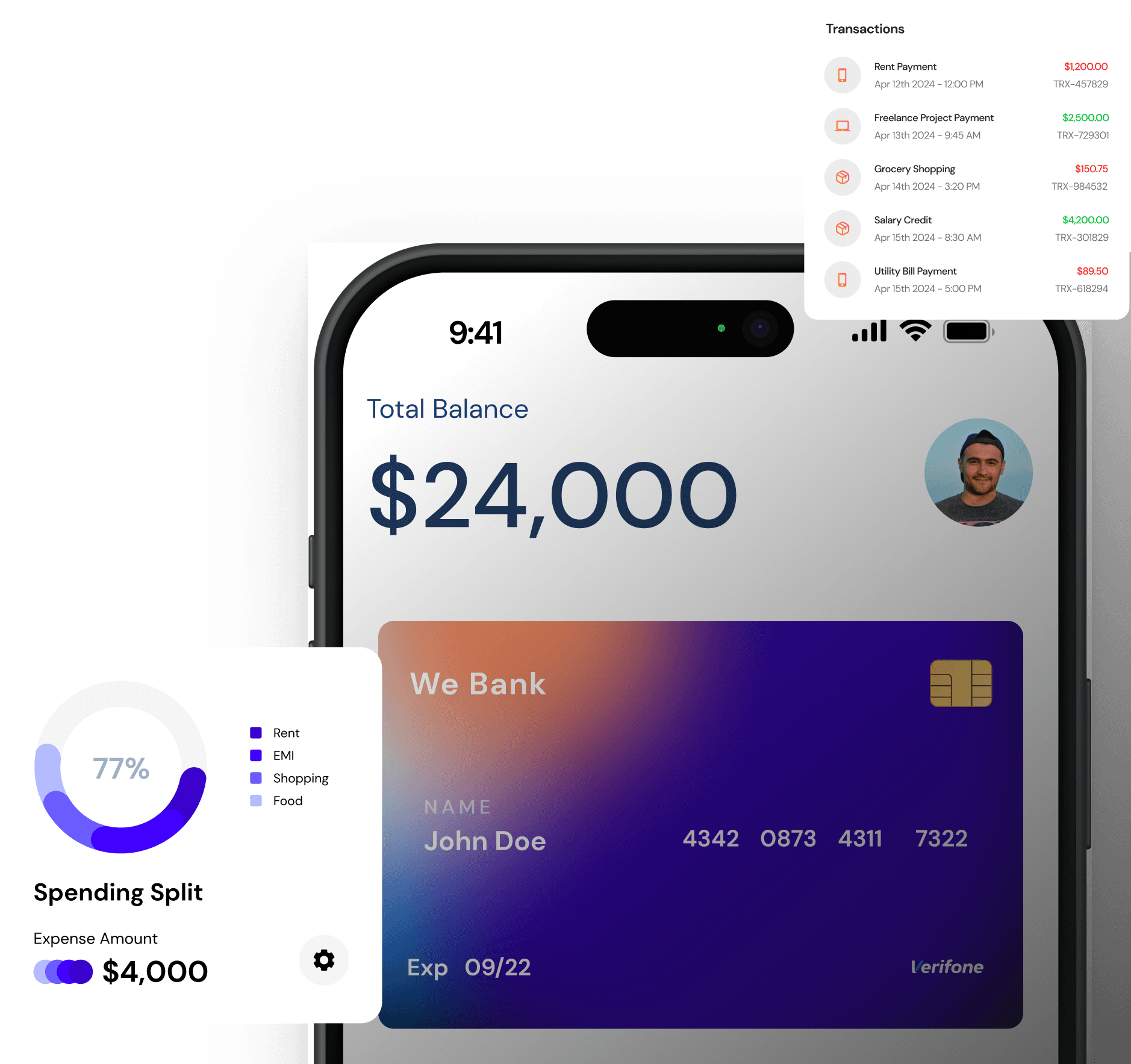

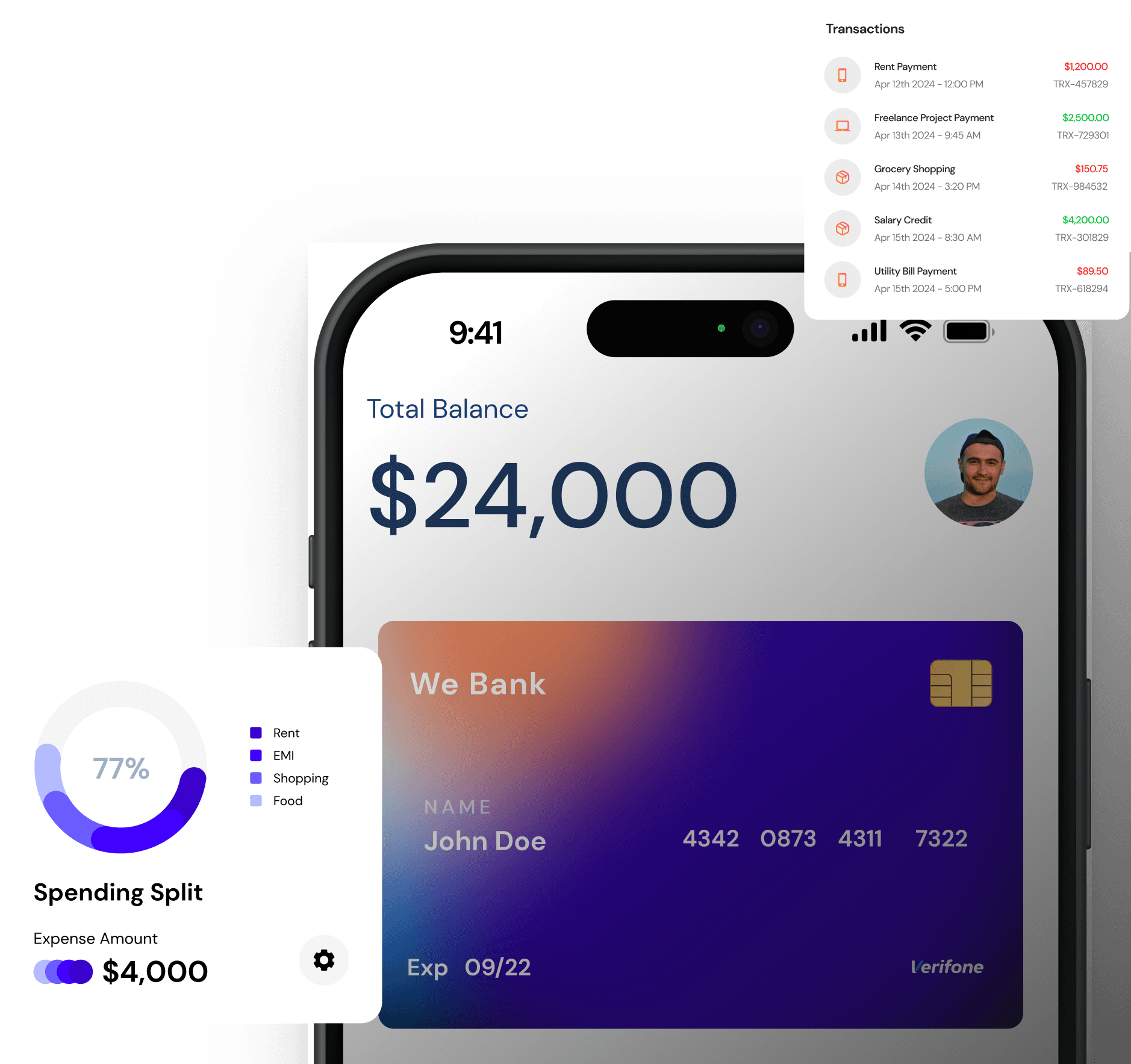

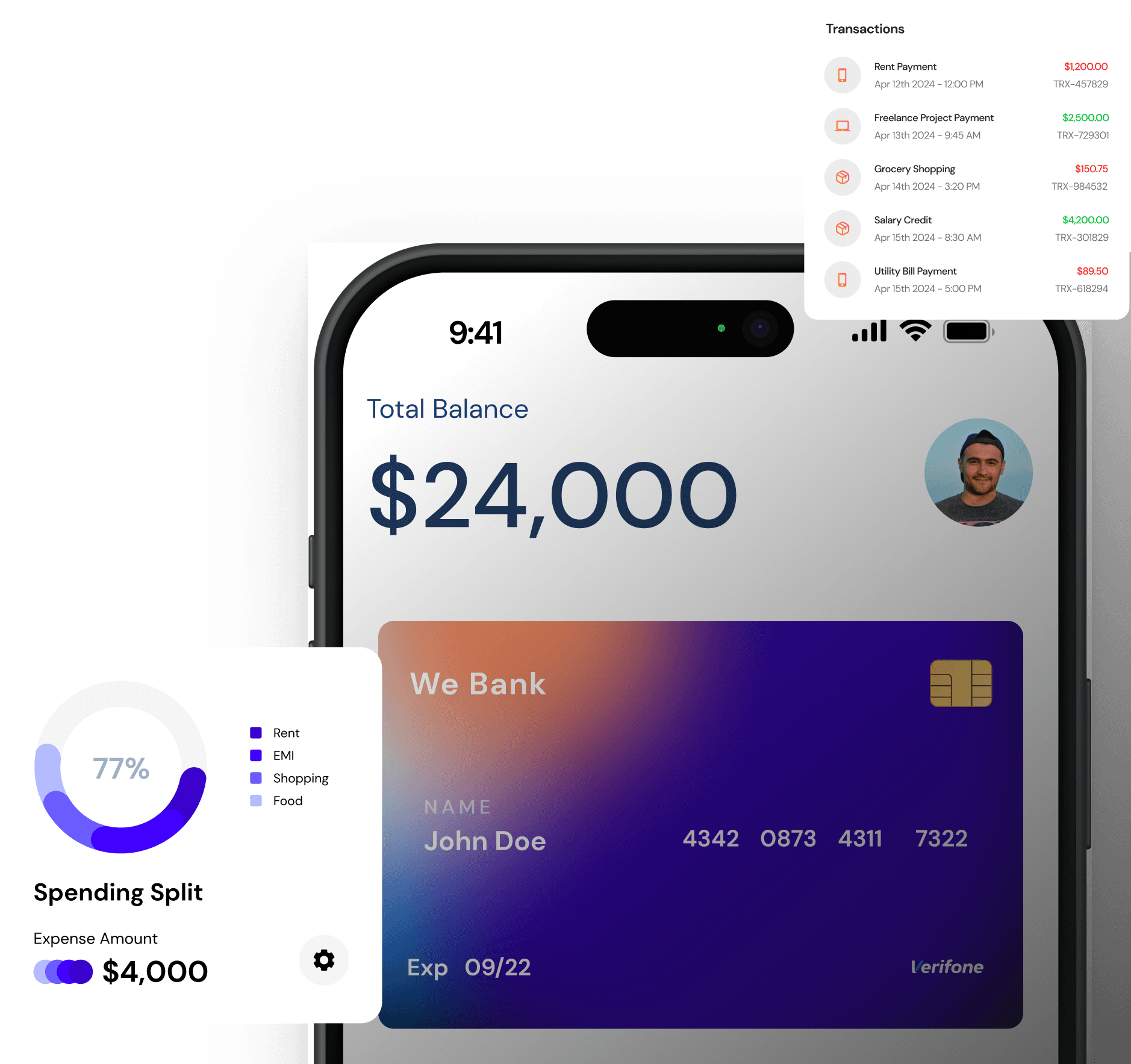

The first step in managing debt is understanding the full scope of what you owe. List all your debts, including credit card balances, personal loans, student loans, and mortgages. Note the interest rates, minimum payments, and due dates for each debt. This comprehensive overview will help you create a structured plan for tackling your debt.

2. Prioritize Your Debt Repayments

Not all debts are created equal. Prioritize your debts based on interest rates and balances. High-interest debts, such as credit card balances, should be addressed first to minimize the amount of interest you pay over time. Use either the debt snowball method (paying off the smallest balances first) or the debt avalanche method (focusing on high-interest debts first) to stay motivated and make significant progress.

3. Create a Realistic Budget

A well-structured budget is essential for effective debt management. Track your income and expenses to identify areas where you can cut back and allocate more funds towards debt repayment. Ensure your budget includes essential expenses, savings contributions, and a designated amount for debt payments. Stick to your budget and adjust it as needed to stay on track.

4. Negotiate Better Terms

Don’t hesitate to contact your creditors to negotiate better terms. Lowering interest rates, extending repayment periods, or consolidating multiple debts into a single loan with a lower interest rate can make managing your debt more manageable. Many creditors are willing to work with you if you demonstrate a commitment to repaying your debts.

5. Explore Debt Consolidation Options

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can simplify your repayments and potentially reduce your overall interest costs. Options include personal loans, balance transfer credit cards, and home equity loans. Carefully evaluate the terms and conditions before choosing a consolidation option.

6. Adopt Smart Budgeting Techniques

Effective budgeting is key to managing debt. Use budgeting tools and apps to track your spending and stay within your limits. Consider the 50/30/20 rule, which allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Adjust this formula based on your specific financial situation and goals.

7. Build an Emergency Fund

While paying off debt is crucial, it's also important to have an emergency fund. Unexpected expenses can derail your debt repayment plan if you’re not prepared. Aim to save at least three to six months’ worth of living expenses in a separate savings account to cover unforeseen costs without adding to your debt.

8. Seek Professional Help if Needed

If you’re struggling to manage your debt on your own, consider seeking professional help. Credit counseling agencies can provide guidance and support, helping you create a debt management plan. Bankruptcy should be a last resort, but in some cases, it may be the best option to regain financial stability.

By following these strategies, you can take control of your debt and work towards financial freedom. Remember that managing debt requires discipline, patience, and a commitment to making positive financial changes. Stay focused on your goals, and celebrate your progress along the way.