Are you looking to secure your financial future and build wealth over time? One of the most effective ways to achieve this is by maximizing your savings. Saving money isn't just about putting aside a portion of your income; it's about adopting smart strategies and making informed decisions to make your money work harder for you. In this blog post, we'll explore practical tips to help you boost your savings and set yourself on the path to financial success.

1. Set Achievable Financial Goals

Before you start saving, it's essential to have clear financial goals in mind. Whether you're saving for a down payment on a house, planning for retirement, or building an emergency fund, having specific, achievable goals will help you stay focused and motivated. Break down your goals into smaller milestones and create a timeline for achieving them.

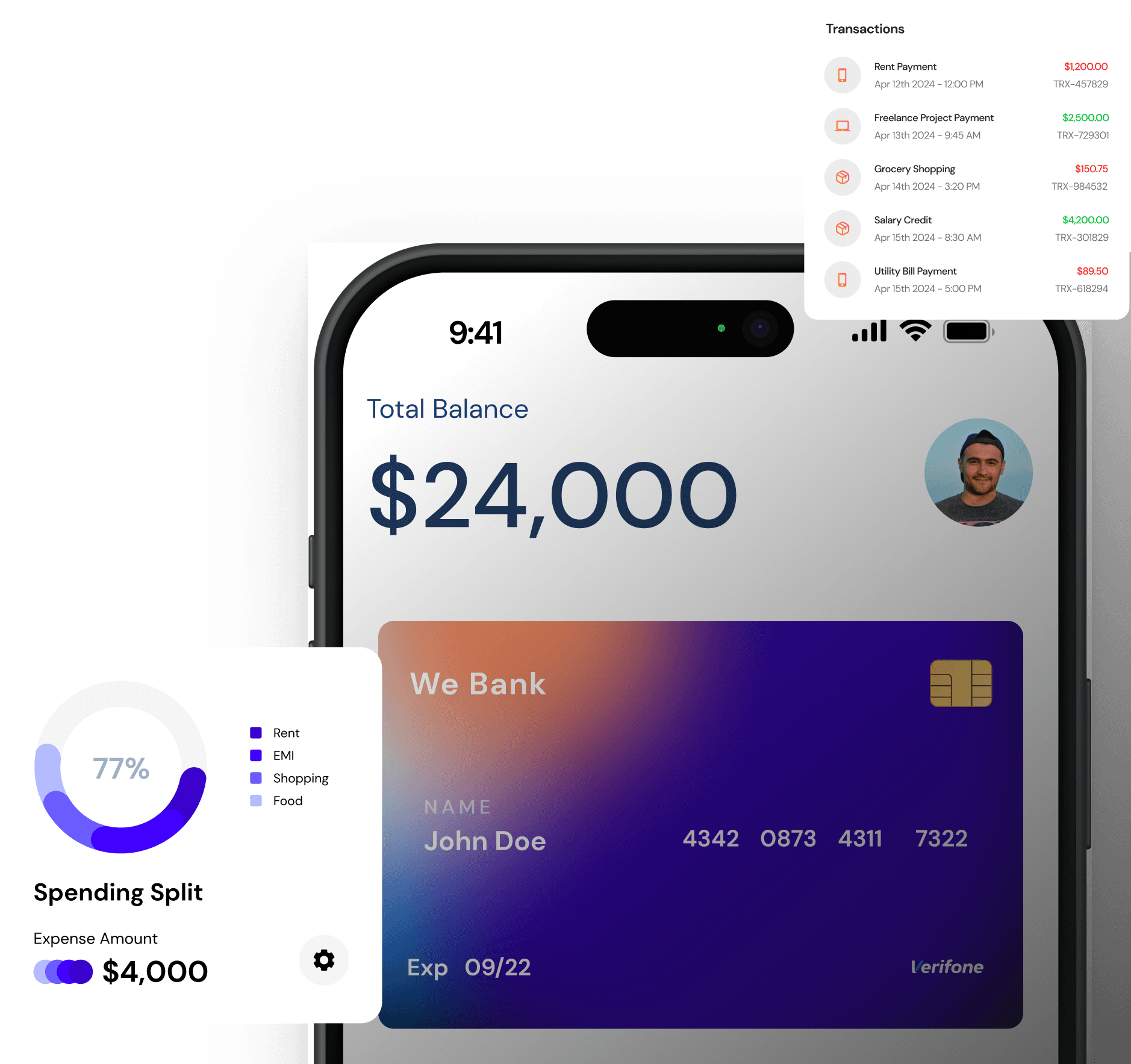

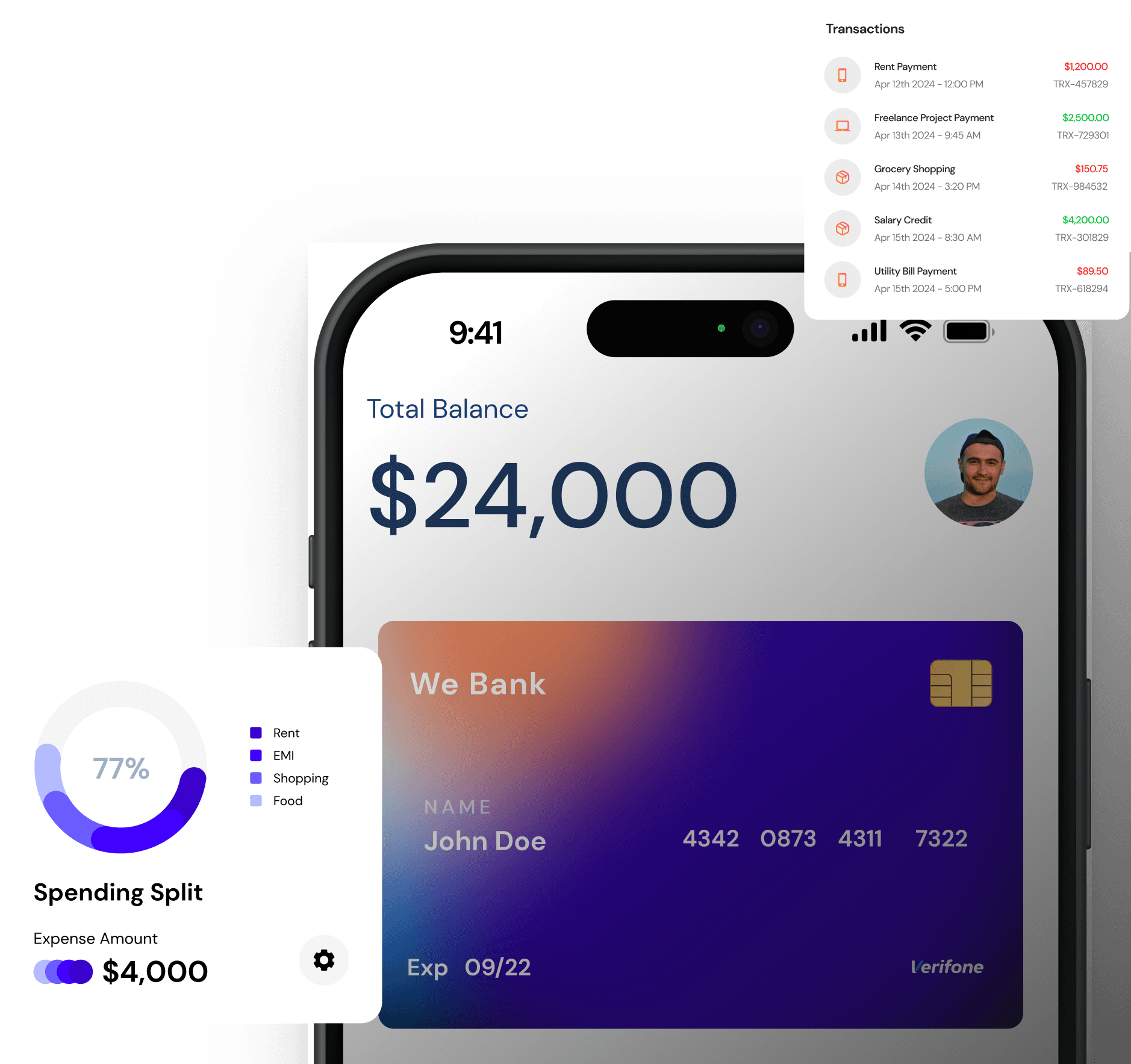

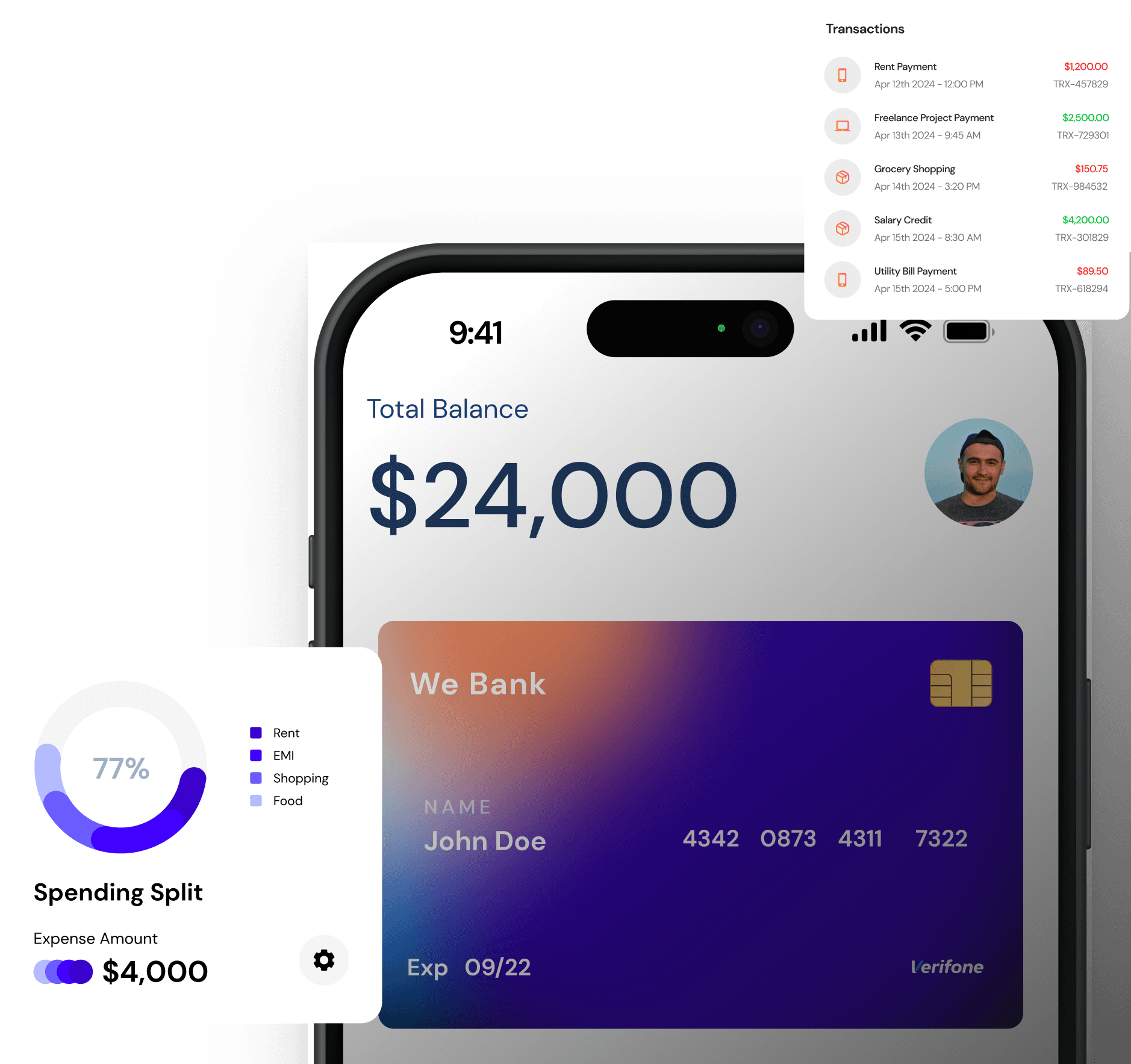

2. Create a Budget and Stick to It

Budgeting is the cornerstone of effective financial management. By creating a budget, you can track your income and expenses, identify areas where you can cut back, and allocate more money towards your savings goals. Be realistic when setting your budget and prioritize your essential expenses while leaving room for discretionary spending.

3. Explore High-Yield Savings Accounts

Traditional savings accounts offer minimal interest rates, making it challenging to grow your savings significantly. Consider opening a high-yield savings account, which typically offers higher interest rates and can help your savings grow faster over time. Compare different accounts and choose one that offers competitive interest rates and low fees.

4. Take Advantage of Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are another excellent option for maximizing your savings. CDs typically offer higher interest rates than regular savings accounts, but they require you to lock in your money for a specified period, ranging from a few months to several years. Choose a CD term that aligns with your financial goals and time horizon.

5. Automate Your Savings

Make saving money a habit by automating your savings contributions. Set up automatic transfers from your checking account to your savings account or investment accounts on a regular basis, such as monthly or bi-weekly. This way, you can ensure that you're consistently setting aside money towards your goals without having to think about it.

6. Reduce Unnecessary Expenses

Identify areas where you can cut back on unnecessary expenses and redirect those funds towards your savings goals. This could involve reducing dining out, canceling unused subscriptions, or finding more cost-effective alternatives for everyday purchases. Small changes in your spending habits can add up to significant savings over time.

By implementing these practical strategies, you can maximize your savings potential and accelerate your journey towards financial independence. Remember that building wealth takes time and patience, so stay committed to your goals and celebrate your progress along the way.

Tags: #SavingsTips #WealthBuilding #Budgeting