The digital revolution has transformed nearly every aspect of our lives, and banking is no exception. Digital banking is reshaping the financial landscape, offering unprecedented convenience, security, and innovative solutions that cater to the needs of modern consumers. In this blog post, we'll explore the rise of digital banking and its transformative benefits, helping you understand why it has become an essential part of today's financial ecosystem.

1. Unmatched Convenience

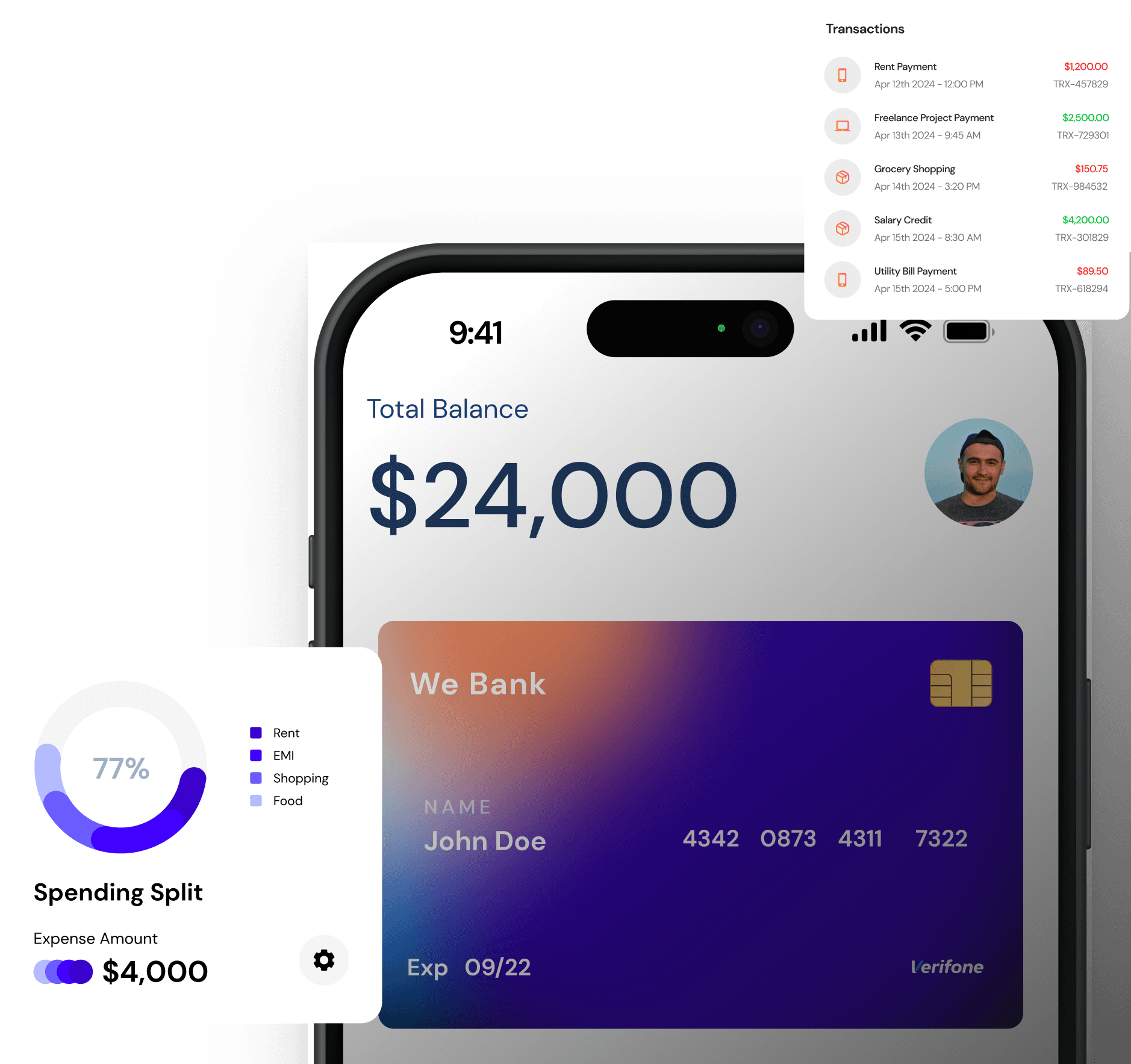

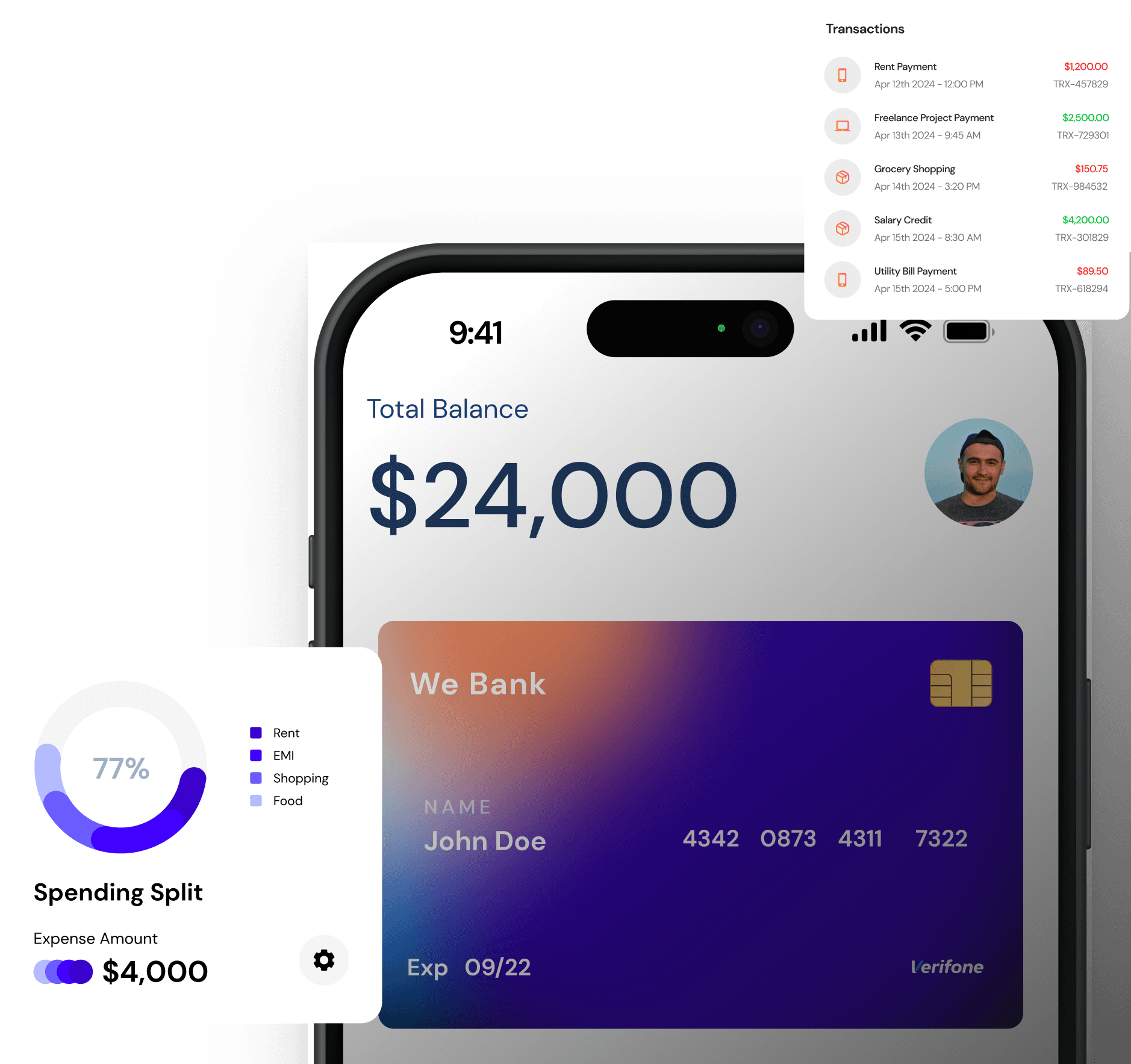

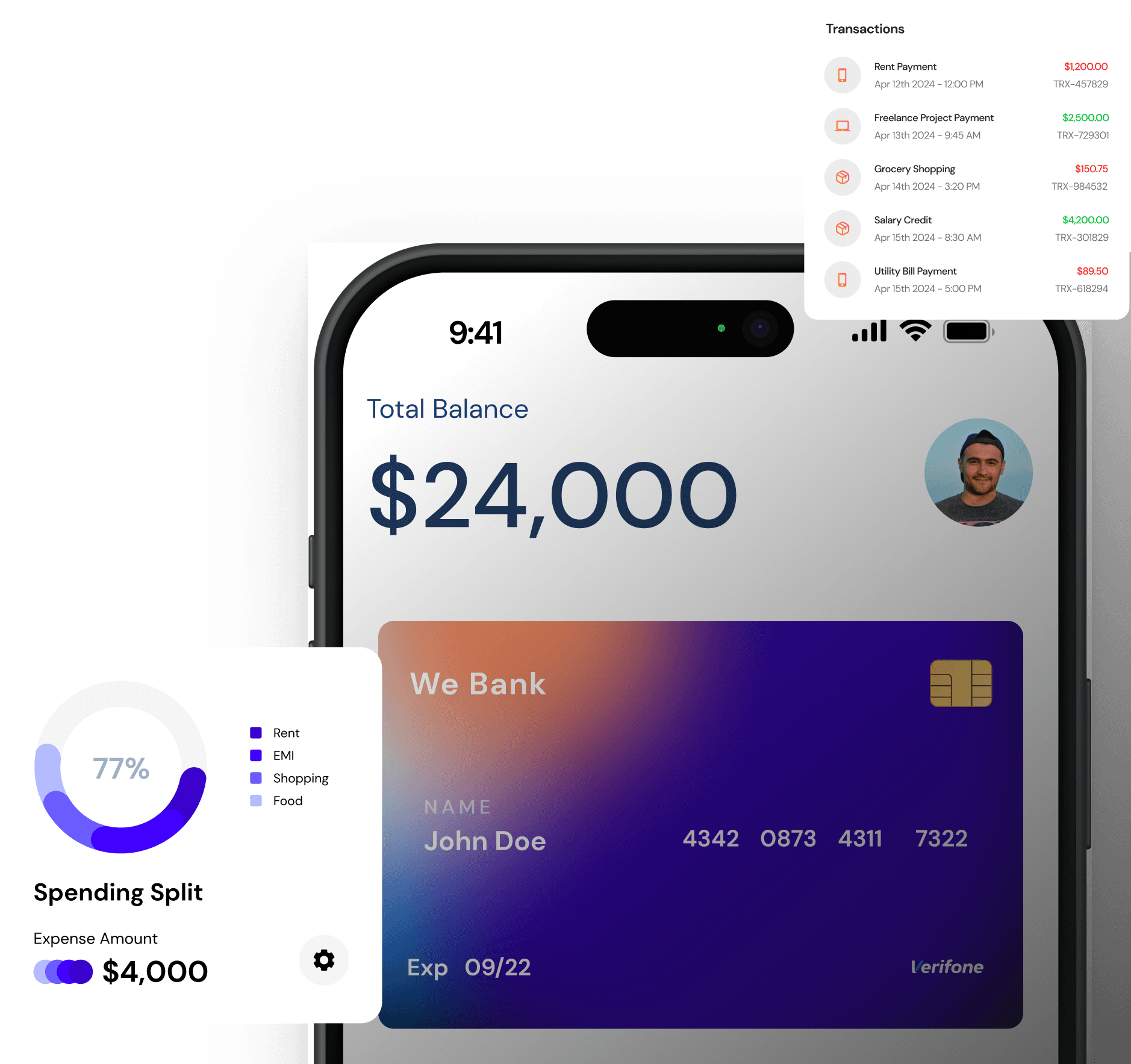

Digital banking brings banking services right to your fingertips, allowing you to manage your finances anytime, anywhere. Whether you're checking your account balance, transferring funds, or paying bills, digital banking platforms provide seamless and instant access to a wide range of financial services. Say goodbye to long queues and limited banking hours – digital banking is all about convenience.

2. Enhanced Security Features

Security is a top priority in digital banking, with advanced technologies designed to protect your financial information. Features such as multi-factor authentication, biometric verification, and encrypted transactions ensure that your accounts are secure. Regular monitoring and real-time alerts help detect and prevent fraudulent activities, giving you peace of mind as you manage your finances online.

3. Mobile Payments and Wallets

The rise of mobile payments and digital wallets is a significant aspect of digital banking. Services like Apple Pay, Google Wallet, and Samsung Pay allow you to make secure, contactless payments with just a tap of your smartphone. These digital wallets store your payment information securely, making transactions quick and hassle-free. Additionally, they offer features like transaction tracking and loyalty rewards integration.

4. Virtual Banking Assistants

Artificial intelligence (AI) is playing a crucial role in enhancing the digital banking experience. Virtual banking assistants, powered by AI, provide personalized support and assistance to customers. Whether you need help with account inquiries, transaction details, or financial advice, these virtual assistants are available 24/7 to provide prompt and accurate responses, making banking more efficient and user-friendly.

5. Innovative Financial Solutions

Digital banking platforms are continuously evolving, offering innovative financial solutions that cater to diverse customer needs. From peer-to-peer (P2P) payments and budgeting tools to personalized financial advice and investment options, digital banks provide a comprehensive suite of services designed to help you achieve your financial goals. These solutions are often integrated into a single platform, providing a holistic and seamless banking experience.

6. Streamlined Account Management

Managing multiple accounts and services has never been easier with digital banking. You can link various accounts, view transaction histories, set up automatic payments, and even apply for loans or credit cards directly through your digital banking app. This streamlined approach simplifies financial management, saving you time and effort.

7. Accessibility and Inclusivity

Digital banking has the potential to enhance financial inclusion by providing banking services to underserved and remote populations. With just an internet connection and a smartphone, individuals who previously lacked access to traditional banking services can now participate in the financial system, opening up new opportunities for economic growth and development.

By embracing digital banking, you can enjoy a more convenient, secure, and efficient banking experience. The continuous advancements in technology promise even greater innovations in the future, making digital banking an integral part of our financial lives.